In early 2018, Mckinsey & Company published an article on why digital strategies fail. It’s a very interesting read and I highly recommend you take a look at it when you have time to really digest it all.

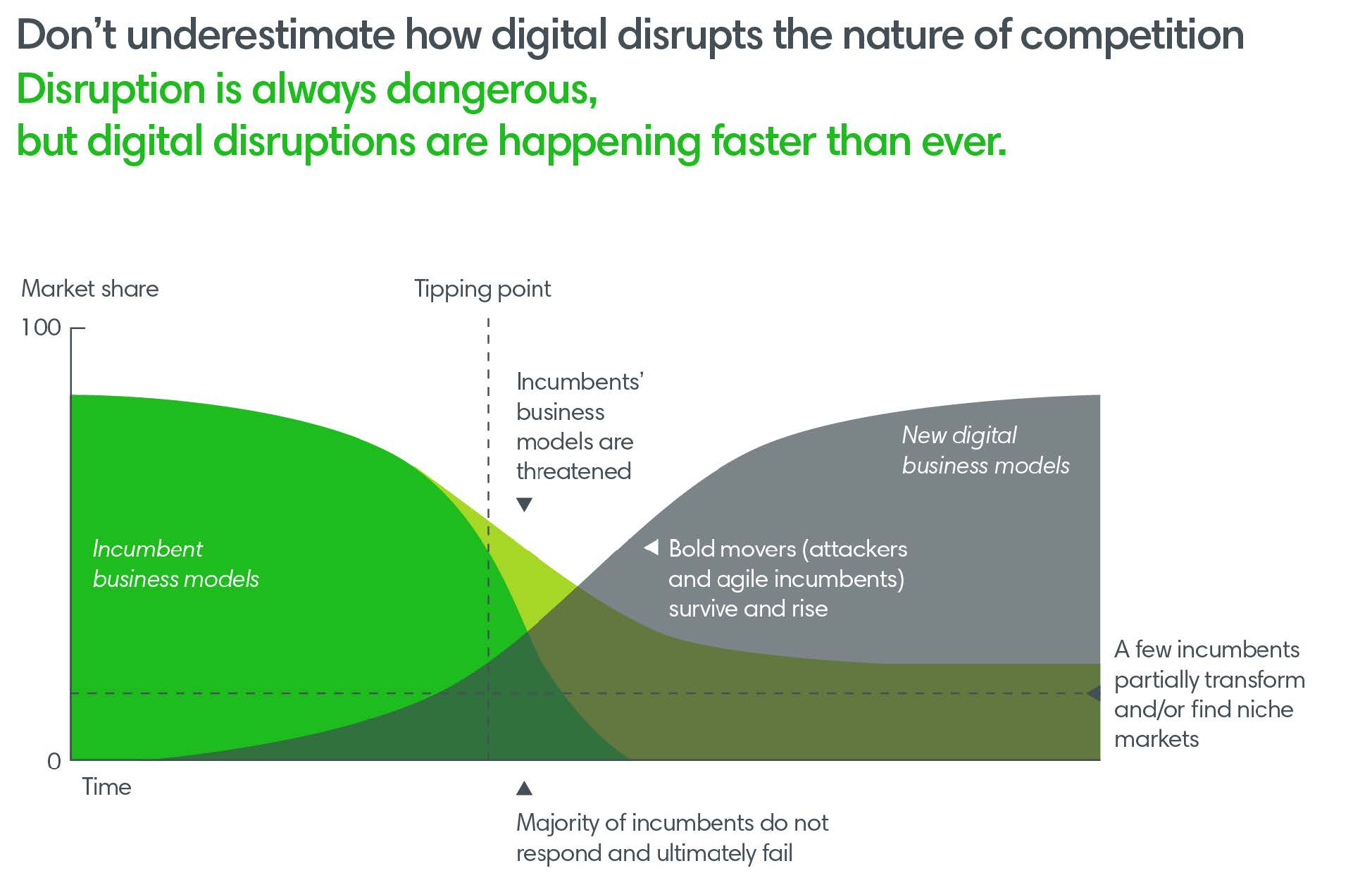

One of the pitfalls they talk about is how companies misunderstand digital economics. This infographic below epitomizes that. It’s a picture that paints a thousand very worrisome words for legacy media (the incumbents) in the digital age.

According to McKinsey’s research, digital:

- Creates, more value for consumers on average than for businesses

- Because it has inverted the traditional power funnel

- Drives “winner-takes-all” economics

- Incumbents who assume market share will remain stable, and niches defendable, do so at their peril

- Rewards those who move first and some superfast followers

- Organizations that develop a learning advantage, scale up platforms, and invest in AI at a much faster pace, allow them to “skate to where the puck is heading”

- Will turn all industries into ecosystems – no one is immune

- Only 3% of incumbents have adopted an aggressive platform strategy in their industry; whereas seven of the 12 largest companies (by market cap) are ecosystem players

So, if you’re not a people-first business and a first mover (or superfast follower) looking to adopt an aggressive platform strategy, then your organization’s future is at risk.

But, being at risk and being dead are two different things. There’s still hope. Research shows that established players that self-cannibalize and disrupt their status quo can be highly competitive in a digital world and tip the balance in their favor. McKinsey calls them “digital reinventers”.

“Revved-up incumbents create as much risk to the revenues of traditional players as digital attackers do. And it’s often incumbents’ moves that push an industry to the tipping point. That’s when the ranks of slow movers get exposed to life-threatening competition.” McKinsey&Company 2018

Be part of the 3%

To be a digital reinventer doesn’t mean needing to design something brand new. One of the greatest reinventers of our time, Steve Jobs, was a master at reinventing what already existed (inside and outside Apple) into something that changed the world – the iPhone.

Nike CEO, Mark Parker, took Jobs’ “Innovate the old” advice when he seized the reins of the iconic brand in 2006 and has been re-innovating its 31-year-old Air Max shoe brand ever since. In 2012, Nike overtook Reebok as the most valuable apparel brand in the world and has never lost the title.

So don’t throw out the baby with the bathwater, as they say. Start by looking the unique value your organization has (from people’s perspective, not your own) and use it to reinvent yourself. This, I surmise, would include quality content (and its creators) and unique people-first experiences you offer (or could offer) that would delight audiences. And bravely divest yourself of archaic business models, cultures, organizational structures, and modes packaging and delivery that are past their “best before” date.

Then do what Steve Job’s did and look at what others have done already and see if it makes sense to add their innovations to your reinvention strategy. Be prepared to acquire assets and purge inside that which has no value to people.

But before doing anything, evaluate yourself and your business in terms of readiness to reinvent.

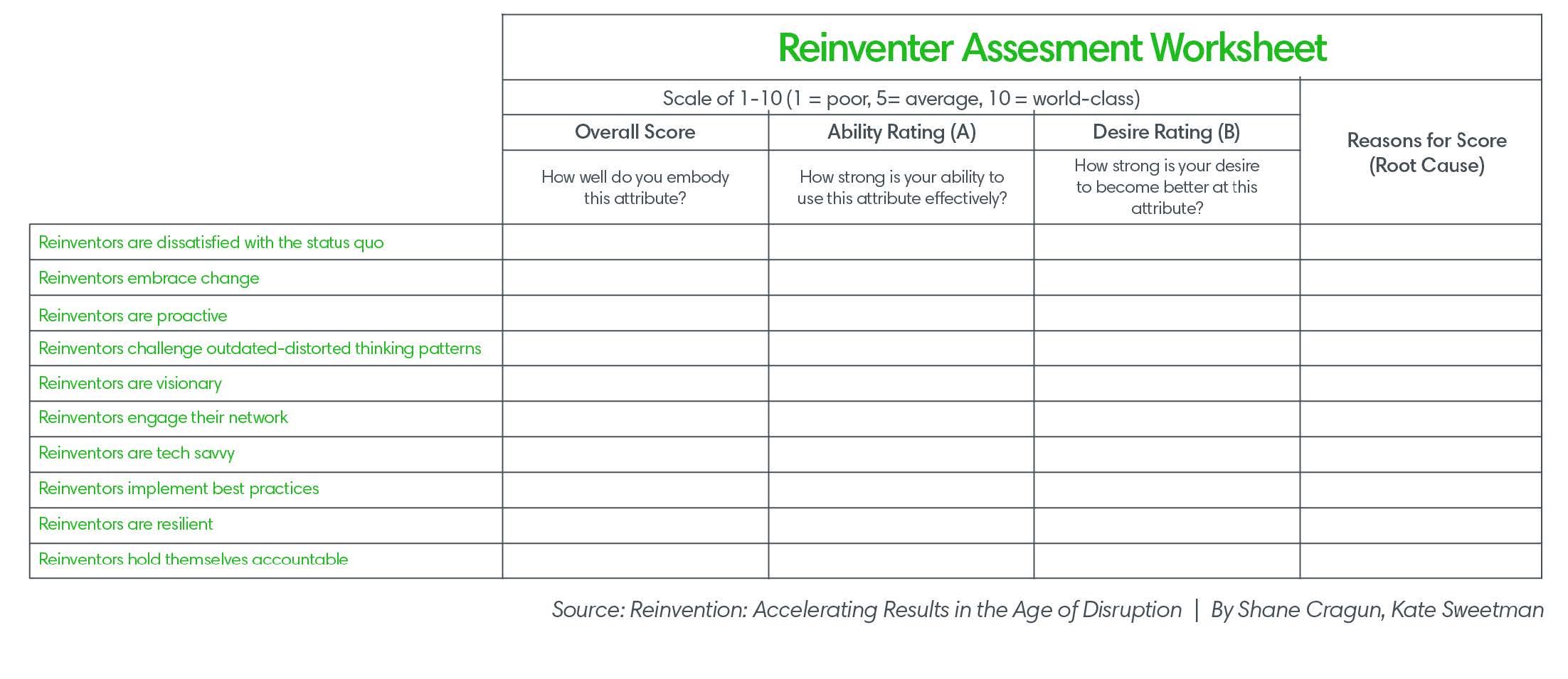

In the popular business book Reinvention: Accelerating Results in the Age of Disruption, authors Cragun and Sweetman assert that the ability to reinvent is the “price of admission to play in today’s global game of business”; it’s one of the most important competencies to master in the 21st century.

They offer an interesting assessment worksheet which can help point out if you or your organization suffer from one of the “six deadly blindfolds” that keep companies from seeing and executing the way forward.

I hope you’ll take the time to fill out this worksheet because, as much as unique quality assets are the foundation of successful reinvention, they aren’t enough. Organizations must be led by change agents that embody what it means to a digital reinventer. This is perhaps the hardest nut to crack because those at the top now may not be the right people to reinvent the business.

According to McKinsey, executives in media, technology, and telecommunication believe their current revenues are at the highest risk from digitization. It’s hard to argue with that given how, over the past 20 years, we’ve witnessed the unrelenting withering of profits and revenues in our industry at global scale.

One would think that that assessment would spur more media executives into becoming reinventers, but that has not been the case. The net gain in revenue growth that has been cannibalized by publishers’ digital adaptations of core products and services has resulted in paralysis, leaving many media companies treading water and underinvesting in digital.

Meanwhile reinventers, who are much more likely to divest lines of business made obsolete before the full effect of disruption was felt, make bolder investment moves and long-term digital acquisitions.

What it takes to be a reinventer

In McKinsey’s October 2017 survey, only 15% of incumbents said they had purchased new digital companies that would be strategically important. Some acquisitions, they knew, wouldn’t add to their short-term revenues, but would in the longer term.

For companies that are not yet reinventers, which are the majority in our industry, there are a few things they can do to kick start the transformation to being one.

- Start by innovating new business models through the digitization of core businesses and the innovation of new digital ones. Dipping ones’ toe into the water (like just converting stories from printed editions into digital) won’t work. It has to be much deeper dive. It’s not going to be easy, both from a cultural and core competency perspective, to make fundamental changes, especially those that start at the top.

- Boldly experiment and evaluate new technologies. You don’t have to be the first to adopt them, but maintaining a “wait and see” approach for too long will likely leave you behind the revenue curve. Remember, digital rewards those who are first-movers and some superfast followers.

- And finally, be decisive in making investments. Risk aversion is a death sentence in the digitally-disruptive world in which we now live – and new technologies moving at accelerated speeds. In my article, AI and the future of journalism, I talk about how computers are doubling their capabilities every 12-18 months. According to Ray Kurzweil, in ten years, technology will have improved 1,000 times from what it is today. That’s hard for many of us to intuit, including me, but the law of accelerating returns is getting faster. If one were to believe Kurzweil (which many do, including governments and the largest companies in the world), in 30 years, the period of “The Singularity” will occur. This is the point at which technology will be a billion times more advanced that it is today – the time when “bio, nano, robotic, and computer technology is so rapid, so advanced, and so profound that today’s limited understanding does not allow us to describe, within reason, what life will be like.”

Now, I’m not trying to be an alarmist, but the future really is now. There is no choice but for us to act, and act assertively, about where we go from here.

When I attended FIPP’s Digital Innovators Summit in March 2018, I heard something at the panel on pivoting to reader revenues (30:29) that gave me pause. It was the most silo-breaking business model I’ve ever heard from an incumbent in our industry. And it gave me hope for a future where the industry could finally work together for a financially-viable future.

“Other industries [music, video] only succeeded with flat fees across all brands or the whole portfolio. Like Spotify and Deezer, you get all music, with Netflix and Amazon video you get almost all videos.

“But in news media you still subscribe to one brand. Yes, you get all the news, but only one brand.

“We always discuss if there is room for some sort of disrupter (and it might not come out of the publishing industry by itself) but maybe there’s room to make a real mass media model.

“There needs to be something in the future which is $10 a month all-in. But we as publishers are not open enough to support that. We are always trying to keep control on the user data, trying to keep control of our news. And so I’m not sure if it will happen, but it’s would be the basis for a really mass media paid content model.”

Stefan Betzold, MD, BILD Group, Germany